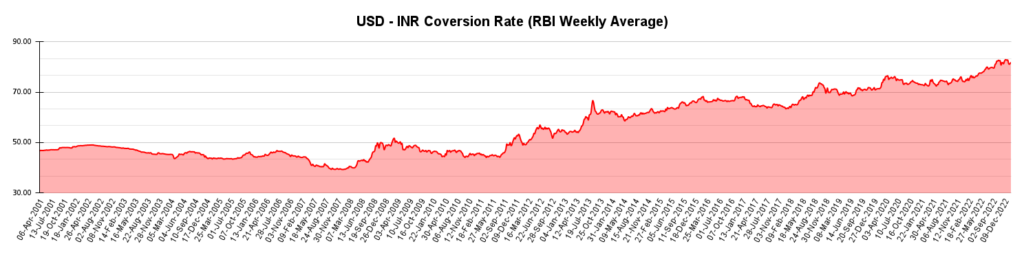

Before 2014, the Indian rupee has experienced periods of depreciation against the US dollar. Some of the major events that led to the depreciation of the Indian rupee against the US dollar are as follows:

- Global financial crisis: In 2008, the global financial crisis caused a flight of capital from emerging markets to safe-haven assets, leading to a sharp depreciation of the Indian rupee.

- Rising crude oil prices: India is a major importer of crude oil, and any increase in crude oil prices has a significant impact on its current account deficit. The rising crude oil prices during 2011-2013 led to a sharp depreciation of the Indian rupee.

- Current account deficit: India’s current account deficit widened to a record high of 4.8% of GDP in 2012-13, which led to a sharp depreciation of the Indian rupee.

- Fiscal deficit: India’s fiscal deficit widened, which led to concerns over the government’s ability to manage its finances, causing a depreciation of the Indian rupee.

- Taper tantrum: In 2013, the US Federal Reserve announced its intention to taper its bond-buying program, which led to a sharp rise in US bond yields and a flight of capital from emerging markets, including India, causing a depreciation of the Indian rupee.

Overall, the depreciation of the Indian rupee before 2014 was mainly driven by external factors such as global economic conditions and rising crude oil prices, as well as domestic factors such as the widening current account and fiscal deficits.

After 2014, the Indian rupee has experienced periods of volatility against the US dollar. Some of the major events that have impacted the value of the Indian rupee against the US dollar after 2014 are as follows:

- Declining crude oil prices: The decline in crude oil prices from mid-2014 to early 2016 benefited India as it lowered the country’s import bill and narrowed its current account deficit, which supported the Indian rupee.

- US Fed rate hikes: The US Federal Reserve started raising interest rates from December 2015, which led to an outflow of foreign portfolio investments from emerging markets including India. This caused volatility in the Indian rupee.

- Demonetization: In November 2016, the Indian government announced demonetization, which caused a temporary disruption to economic activity and resulted in a slowdown in GDP growth. This led to a depreciation of the Indian rupee.

- GST Implementation: The implementation of the Goods and Services Tax (GST) in July 2017 led to confusion and disruption in the economy, causing a depreciation of the Indian rupee.

- COVID-19 pandemic: The COVID-19 pandemic led to a global economic slowdown and flight of capital from emerging markets, causing a depreciation of the Indian rupee in 2020. However, the Indian government and central bank took several measures to support the economy and stabilize the currency.

Overall, the Indian rupee has experienced periods of volatility against the US dollar after 2014, mainly driven by external factors such as US interest rates, global crude oil prices, and the COVID-19 pandemic, as well as domestic factors such as demonetization and GST implementation.

Rupee versus Dollar trading plummeted to historical lows. Rupee trading almost 13% lower than what it traded at the start of this year. For the past four years there was considerable drop in dollar outflow due to cheaper crude oil prices. This has resulted in natural strengthening of rupee and Modi bhakts attributed this achievement to relentless hard work Modiji. What they never visualized /envisioned is the situation they luckily got into would not stay longer and could haunt them later with no principled changes.?

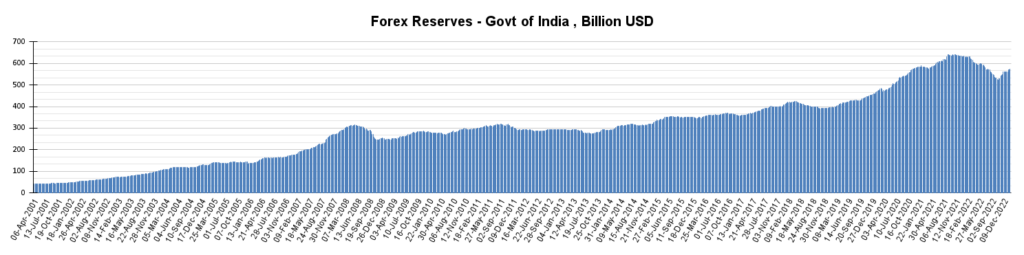

Modi supporters claimed on growing forex reserves with stronger make in India policy was reason for strengthening rupee. During UPA-I regime forex reserve grown from 100 Billion to 300 Billion USD. UPA-II coupled with high crude prices caused a slippery forex reserve but did sustained at same level. Modi had a cheaper crude prices again helped to increase the forex to 400 Billion and started to slip again when the crude prices increased.

It is true that foreign exchange reserves have grown under the Modi government, and this has been touted as one of the achievements of the government’s “Make in India” policy. The foreign exchange reserves in India reached a record high of $590 billion in January 2021, from around $300 billion in 2014 when the Modi government came to power.

However, it is important to note that the growth of foreign exchange reserves is not solely determined by the government’s policies, but is also influenced by external factors such as global economic conditions, capital inflows, and commodity prices. For example, the decline in crude oil prices in 2014-2016, which was largely beyond the control of the government, helped to boost India’s foreign exchange reserves.

During the UPA-I regime, foreign exchange reserves grew from around $100 billion in 2004 to around $300 billion in 2008. This was largely due to a period of high economic growth and capital inflows. However, during UPA-II, foreign exchange reserves remained relatively stable, despite the impact of high crude oil prices on the economy.

Overall, while the growth of foreign exchange reserves can be influenced by government policies, it is also subject to external factors that are beyond the control of any government. Therefore, it is important to consider both internal and external factors when analyzing the performance of the Indian economy and its currency.

Overall during the entire 10 year UPA regime the forex had at 100% and 0% growth rates per each term respectively. While during Modi term it was 33% growth. However in absolute terms the average remained more or less same. No need to claim any credits on forex reserve growth for any party.

It is true that during the UPA regime, the growth of foreign exchange reserves was relatively stable, with a growth rate of around 100% during UPA-I and 0% during UPA-II. During the Modi government’s tenure, the growth rate of foreign exchange reserves has been around 33%.

However, it is important to note that the absolute value of foreign exchange reserves has remained more or less the same over time, and this growth in reserves is influenced by various external and internal factors. Therefore, it may not be appropriate to attribute credit or blame for the growth or decline of foreign exchange reserves solely to any particular government or political party.

It is essential to consider other economic indicators and policies that contribute to the overall growth and development of the economy and not just focus on foreign exchange reserves. The health of the economy is determined by a wide range of factors, including GDP growth, inflation, employment, trade, fiscal and monetary policies, and so on.