currency demonetization in india 2016

Objective of demonetisation was well defined by Prime Minister and Finance Minister in various recorded statements with clear objective of lessen the cash circulation, converting digital economy to largest extent providing a side benefit of lesser corruption.

To break the grip of corruption and black money, we have decided that the five hundred rupee and thousand rupee currency notes presently in use will no longer be legal tender from midnight tonight, that is 8th November 2016

On 8th November 2016 Indian Prime Minister Narendra Modi, demonetisation speech to nation

……when an economy is evolving from a developing economy into a developed economy, you cannot have 12% of India’s GDP in shape of currency. Ideally developed countries have only about 4% and therefore you have to squeeze the amount of currency available and you need to get people into the habit of using digital, cheques, plastic currency and so on.

10th November 2016 In an exclusive interview with ET Now, Arun Jaitley, Finance Minister

Demonetization is a term used to describe the process of withdrawing a particular type of currency from circulation. In 2016, the Indian government announced the demonetization of high-value banknotes, specifically the 500 and 1000 rupee notes, in an attempt to combat corruption, counterfeiting, and the black market economy. The move was a bold one, affecting the entire country, and it had significant implications for the Indian economy. In this article, we will explore the effects of demonetization on the Indian economy in detail, analyzing both the short-term and long-term impact of the move.

Short-term impact of demonetization:

The short-term impact of demonetization was immediate and widespread. In the immediate aftermath of the announcement, there was chaos and confusion, as people rushed to exchange their old banknotes for new ones. Banks and ATMs were overwhelmed, and there were long queues outside of them. The shortage of cash led to a cash crunch, which had a severe impact on small businesses and the informal sector, which relied heavily on cash transactions.

Despite the initial difficulties, there were some short-term benefits to the move. The withdrawal of high-value banknotes did lead to a reduction in black market activities, as many illegal transactions were conducted in cash. There was also a temporary increase in digital payments, as people were forced to use electronic means of payment in the absence of cash.

However, the short-term impact of demonetization was not all positive. The cash crunch had a severe impact on the Indian economy, with many small businesses and the informal sector suffering. The agricultural sector, which relied heavily on cash transactions, was also hit hard, with farmers struggling to sell their produce in the absence of cash. The GDP growth rate for the following quarter was also affected, with the rate dropping from 7.5% to 6.3%.

Long-term impact of demonetization:

The long-term impact of demonetization is still being debated, with different experts having different opinions on the matter. Some argue that the move was a necessary step towards a more digital economy, while others believe that it had negative consequences for the Indian economy.

One of the long-term effects of demonetization was an increase in digital payments. The move to demonetize high-value banknotes did push more people towards digital transactions, and the government implemented several initiatives to promote digital payments, such as the Unified Payments Interface (UPI) and BHIM app. Today, digital transactions are more popular than ever, with the UPI reporting over 2 billion transactions in January 2021 alone.

However, it is important to note that a shift towards a more digital economy is not necessarily synonymous with a corruption-free one. Digital transactions can still be used for illegal activities, and corruption can still occur in digital transactions. It is crucial to address the root causes of corruption, such as lack of transparency and accountability in government and businesses, rather than rely solely on technological solutions.

Another long-term effect of demonetization was the impact on the informal sector. The cash crunch caused by demonetization had a severe impact on small businesses and the informal sector, which rely heavily on cash transactions. Many small businesses were forced to shut down, and there was a significant loss of jobs in the informal sector.

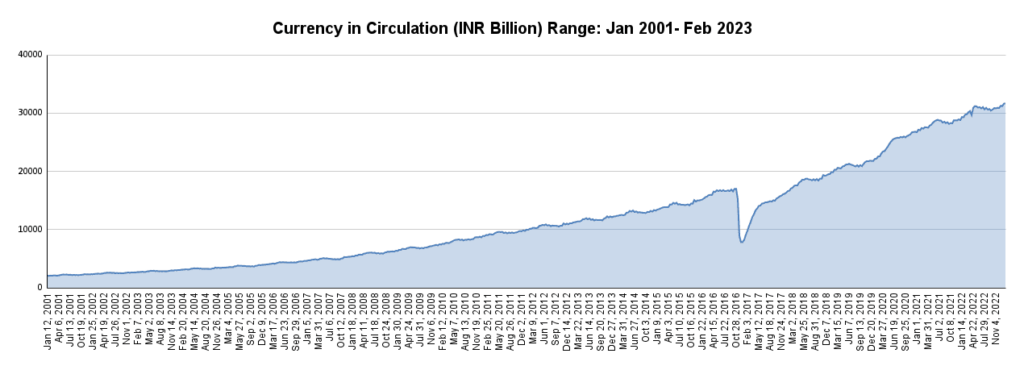

Objectives Lower Cash Circulation Failed Miserably:

The Reserve Bank of India (RBI) releases a weekly statistical supplement that provides information on various economic indicators, including the circulation of currency notes. According to the data published in the supplement, the circulation of currency notes dropped significantly immediately after demonetization was announced in November 2016. However, it gradually recovered and reached pre-demonetization levels in mid-2018, and has been growing steadily since then.

The demonetization of high-value banknotes resulted in a shortage of cash in the economy, which had a significant impact on various sectors, including agriculture, informal businesses, and rural areas, which are heavily dependent on cash transactions. The government’s push for digital transactions and other measures to promote cashless payments also contributed to the drop in cash circulation.

According to the RBI’s weekly statistical supplement, the circulation of currency notes dropped from a high of Rs 17.9 lakh crore in the week ending October 28, 2016, to a low of Rs 7.7 lakh crore in the week ending January 6, 2017, a decline of more than 57 percent. However, the circulation of currency notes gradually started to recover from February 2017, and by mid-2018, it had reached pre-demonetization levels. The circulation of currency notes has continued to grow since then and reached a high of Rs 27.7 lakh crore in the week ending February 18, 2022, an increase of more than 55 percent from pre-demonetization levels.

While the demonetization of high-value banknotes was aimed at reducing cash circulation and promoting digital transactions, the drop in cash circulation had several negative effects, particularly on the informal sector, which was hit hard by the cash shortage. Many small businesses were forced to shut down, and workers in the informal sector lost their jobs or experienced a decline in income. The cash crunch also had a negative impact on the agricultural sector, which relies heavily on cash transactions.

In conclusion, the circulation of currency notes dropped significantly immediately after demonetization was announced in November 2016, but gradually recovered and reached pre-demonetization levels by mid-2018. The circulation of currency notes has continued to grow since then, and as of February 2022, it has surpassed pre-demonetization levels. While the drop in cash circulation was a short-term effect of demonetization, the move had several negative effects on the economy, particularly on the informal sector and rural areas, which are heavily dependent on cash transactions.

Corruption was slowing down before the demonetization and started picking up again with loads of new cash bundles caught and currency getting out of circulation. This had been proved with Corruption Perceptions Index reported by Transparency International

Sources:

- https://www.business-standard.com/article/economy-policy/full-text-pm-modi-s-2016-demonetisation-speech-that-shocked-india-117110800188_1.html

- https://economictimes.indiatimes.com/markets/expert-view/demonetisation-decision-was-a-logical-step-in-journey-towards-cashless-society-arun-jaitley/articleshow/55352466.cms

- Database on Indian Economy, Amount in Rupees Crore, Money Stock : Components and Sources, https://dbie.rbi.org.in/DBIE/dbie.rbi?site=publications