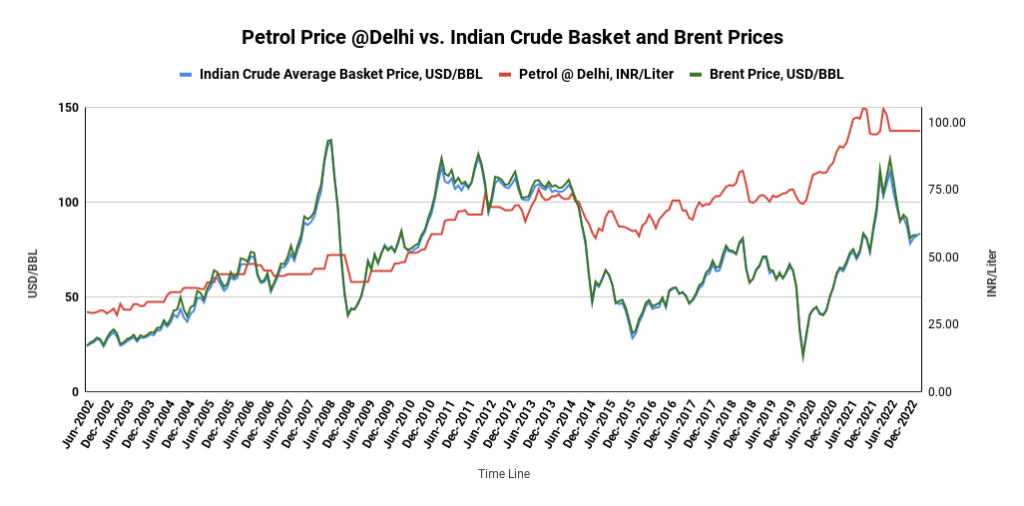

Petrol prices in India have been a source of significant debate and discussion in recent years, with many people questioning the reasons behind the fluctuations in the retail price. While it is true that the price of petrol in India is influenced by the international price of crude oil, there are several other factors at play that contribute to the final retail price.

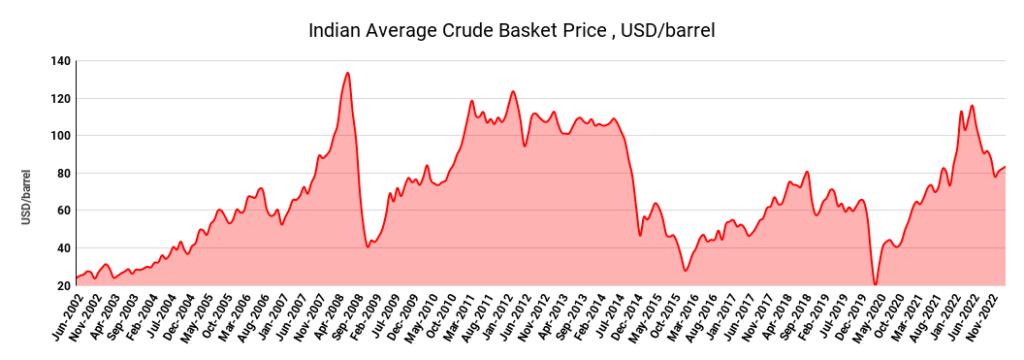

To understand the pricing of petrol in India, it is important to consider all the factors that contribute to the final retail price. One such factor is the Indian Crude Basket Pricing, which is published by the Petroleum Planning & Analysis Cell. This pricing index takes into account the average price of various crude oils that are imported into India, and it is used by oil companies in India to calculate the cost of importing crude oil.

In addition to the cost of importing crude oil, there are several other factors that contribute to the final retail price of petrol in India. One such factor is transportation costs, which include the cost of transporting crude oil from the port to the refinery, and the cost of transporting refined petrol from the refinery to the retail outlets.

Another significant factor that contributes to the final retail price of petrol in India is taxes. The central government and the state governments impose various taxes on petrol, which can account for a significant portion of the final retail price. The state taxes on petrol vary across different states, which is why the retail price of petrol can differ significantly across different regions in India.

It is common practice to take the price of petrol in Delhi as a reference point for analyzing the pricing of petrol in India. This is because Delhi has one of the lowest state taxes on petrol in the country, and the price of petrol in Delhi is less influenced by local market dynamics as compared to other regions.

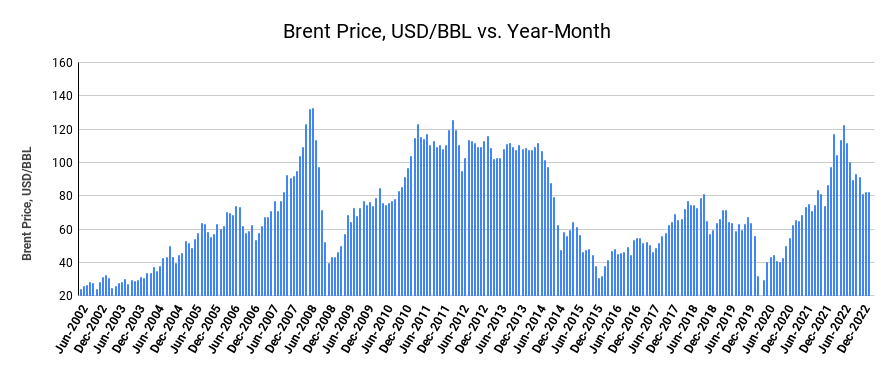

The price of crude oil increased in 2009 and continued to rise in the following years. In 2009, the average price of Brent crude oil was around $61 per barrel. By 2011, the average price had risen to over $111 per barrel. The increase in crude oil prices during this period was primarily driven by a combination of factors, including increased demand from emerging markets like China and India, geopolitical tensions in the Middle East, and supply disruptions due to conflicts in countries like Libya and Iraq.

After reaching highs above $100 per barrel in mid-2014, crude oil prices began a rapid decline, dropping to around $50 per barrel by early 2015. This drop in price was due to several factors, including increased production by the United States, a slowdown in demand from China, and a decision by the Organization of the Petroleum Exporting Countries (OPEC) to maintain its production levels despite the oversupply of oil on the market. The price of crude oil remained relatively low for several years, with occasional fluctuations, before gradually rising again in 2018 and 2019.

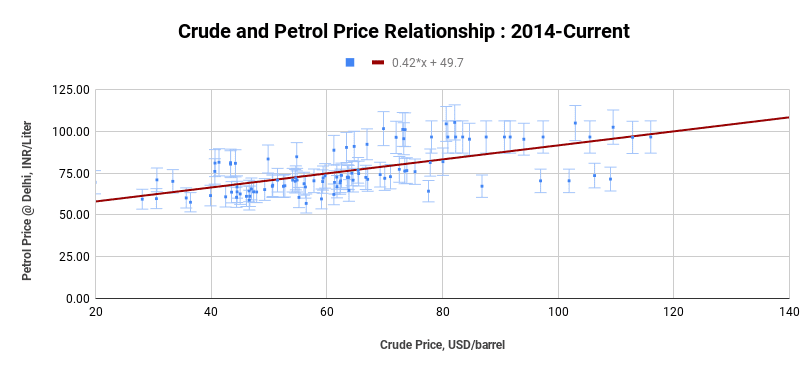

Modi government immensely benefited when crude crashed from an average of USD 111 per barrel (peak 125 USD/Barrel) to less than USD 50 per barrel. Instead of passing the benefit to consumer they collected hoard of cash without drastically dropping the fuel price at pump.

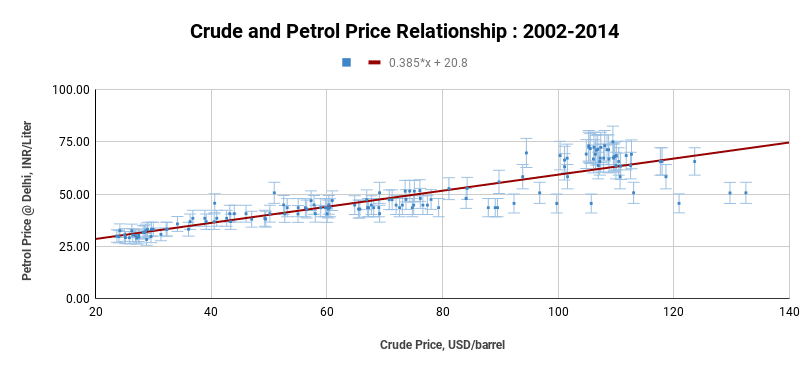

Definitely crude oil was on rising spree in global markets in early to late 2018 and getting back to lower range close to the year end. However one cannot link it to the rise nor state of product pricing. Crude oil is currently at 60% of the historical high prices reached between 2012 to 2014 and product price are almost hovering at prices of 2014.

Supporters of the Modi (Bhakts) immediately attributed the decrease in petrol prices to the Prime Minister’s negotiation skills with Iran for rupee payment and efficient administration, dubbing it “Modi magic.” However, their assumption was based on the belief that crude oil prices would continue to remain historically low, thereby eliminating the need to defend their argument in the future.

Validate.News collected enormous data to refute these false claims. There are three distinct datasets that would help in understanding this concept. Firstly the international Brent price which is benchmark price for crude. However there are thousands of crudes available with pricing that could vary +-50% based on the constituents and ease of processing. In order to understand what oil companies in India are paying one has to dig basket price data which is published by national petroleum planning and analysis cell. Retail prices are published by IOC for various metro cities. For detangling state taxes which usually are higher than Delhi, we had taken Delhi price as standard.

Our Analysis proved Modi government not only reaped the benefit of crude, but also started increasing the price of products when the crude started inching upwards. What this mean is Modi had created an additional constant cash flow to the government funding his pet projects.

Before anyone jumps onto conclusions about data validity, let us be very clear about the data sources:

- Brent Crude Historical Pricing from U.S. Energy Information Administration (EIA)

- Indian Crude Basket Pricing from Petroleum Planning & Analysis Cell

- Petrol Prices at Pump by Indian Oil Corporation